EPJ Data Science Highlight - Identifying inequality in the velocity of cryptocurrency

- Details

- Published on 04 April 2025

Analysis of a new framework for tracking cryptocurrency velocity reveals deep inequalities, driven not just by wealth but by economic behaviours of individuals

The ‘velocity of money’ describes the number of times a unit of currency is used to purchase goods or services within a given time period – or in other words, the number of times that money is changing hands. The quantity is a key indicator of the behaviours of economies as a whole – but today, researchers are still uncertain as to how the concept translates to the fast-growing field of cryptocurrency.

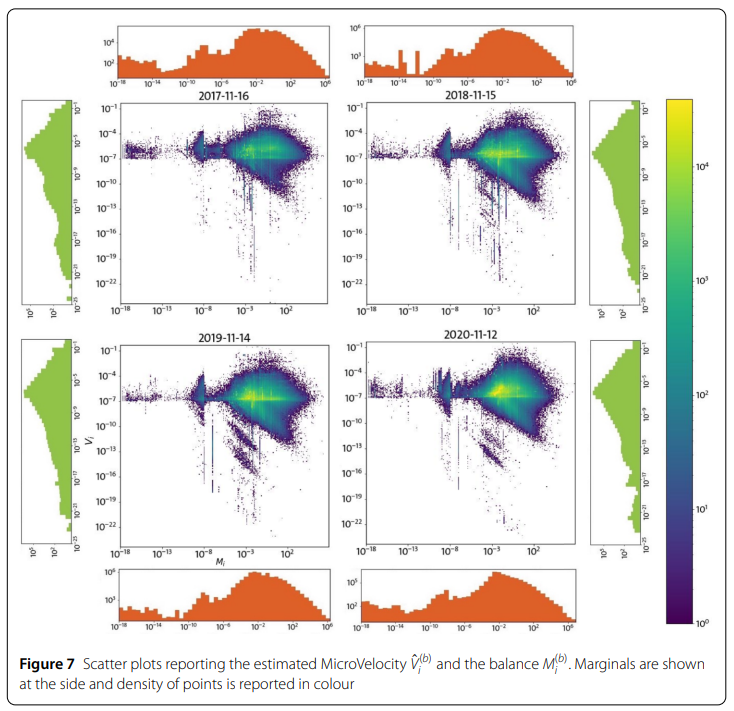

Through new analysis published in EPJ Data Science, Francesco Maria De Collibus and colleagues at the University of Zurich investigate a newly developed framework for measuring the velocity of cryptocurrencies – named ‘MicroVelocity’. Their analysis reveals that many of the same inequalities in wealth distribution found in the economy as a whole are also reflected in MicroVelocity.

The concept of money as uniform measure for the exchange of goods and services is a fundamental pillar of economics. Historically, the velocity of money has been a key tool for understanding how economics is linked to inflation and price levels. However, the situation becomes more complex in the case of cryptoassets: digital representations of ownership which use blockchain technology to ensure security and decentralised ownership and include cryptocurrencies such as Bitcoin.

In their study, the authors applied the MicroVelocity framework to Ether: the primary cryptocurrency used within the Ethereum network of cryptoassets. Within the framework, they studied how velocity and its top contributors can be characterised within the Ethereum ecosystem.

Much like in the broader economy, their analysis revealed that deep inequalities in wealth distribution also appear in MicroVelocity. However, this distribution can’t be explained by wealth alone: in addition, it is heavily influenced by the behaviours and economic activities of individuals, including their spending habits and transaction frequencies.

De Collibus, F.M., Campajola, C. & Tessone, C.J. The microvelocity of money in Ethereum. EPJ Data Sci. 14, 11 (2025). https://doi.org/10.1140/epjds/s13688-024-00518-6