EPJ B Highlight - ID microstructure of stock useful in financial crisis

- Details

- Published on 22 November 2017

New study of the trading interactions that determine the stock price using AI algorithms reveals unexpected microstructure for stock evolution, useful for financial crash modeling

Every day, thousands of orders for selling or buying stocks are registered and processed within milliseconds. Electronic stock exchanges, such as NASDAQ, use what is referred to as microscopic modelling of the order flow - reflecting the dynamics of order bookings - to facilitate trading. The study of such market microstructures is a relatively new research field focusing on the trading interactions that determine the stock price. Now, a German team from the University of Duisburg-Essen has analysed the statistical regularities and irregularities in the recent order flow of 96 different NASDAQ stocks. Since prices are strongly correlated during financial crises, they evolve in a way that is similar to what happens to nerve signals during epileptic seizures. The findings of the Duisburg-Essen group, published in EPJ B, contribute to modelling price evolution, and could ultimately be used to evaluate the impact of financial crises.

The dynamics of stock prices typically shows patterns. For example, large price changes arise in a sequence, which is ten times larger than the average. By studying the microstructure of stock transactions, researchers have previously identified groups of stocks with similar stock order flow. However, there are still many open questions about the co-evolution of different stocks. In fact, our current knowledge of trading interactions is far less developed than our knowledge of the actual prices that are a result of the microscopic dynamics.

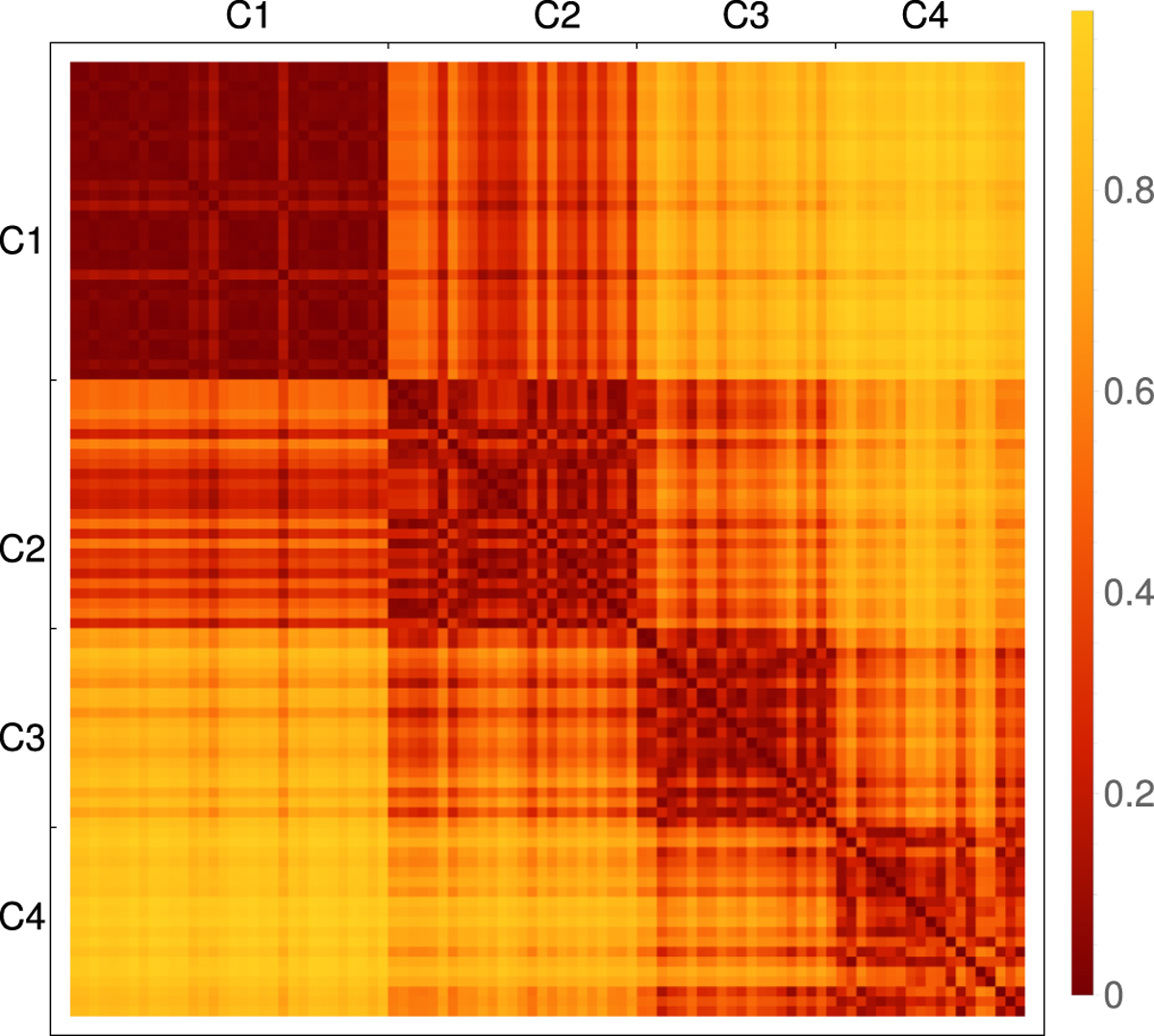

In this study, the authors analyse the co-evolution of order flow for pairs of stocks listed in the index NASDAQ 100. They observe an abstract distance between every pair of stocks. The distance is small if both stocks behave similarly, and large if they behave differently. Using machine learning algorithms, they find that there are four groups of stocks with large mutual differences (large distances). This is surprising, as this rich microscopic diversity is not reflected in the actual prices.

M. Theissen, S. M. Krause, and T. Guhr (2017), Regularities and Irregularities in Order Flow Data,

European Physical Journal B 90: 218, DOI: 10.1140/epjb/e2017-80087-6